Retailers and wholesalers express serious concerns over the draft Late Payments Regulation introduced by the Commission in September 2023. The impact on businesses and especially SMEs in Europe will be disproportionate and dramatic if the proposal is not seriously reconsidered.

The draft Regulation goes beyond its intent to address late payments (breach of contract) and is in fact an absolute restriction of freedom to negotiate payment terms beyond 30 days. No EU country has rules that are as drastic. Countries with stricter requirements, such as the Netherlands, have some form of derogation or flexibility in place.

Our key issues

#FlexNotFixed

European businesses currently operate with 30 day, 60 day or more payment terms. They provide the flexibility and choice needed by different businesses to grow, compete, and invest. Long payments terms are not late payments if terms are agreed and followed.

Wholesalers support their business customers by providing them with supply chain financing through longer payment terms. The current rules offer contractual flexibility that is key to how Europe’s retail and wholesale sectors operate efficiently and effectively.

Let’s focus on the problem rather than breaking a system that works for everyone else.

Point of views

Professor Konrad Raczkowski on Late Payments

Professor Konrad Raczkowski on Late Payments Part 2

EuroCommerce Economist

Italian electronics retailer

French retailer

French toy manufacturer

Austrian book wholesaler

French toy store

Dutch bookstore

What’s the Draft Late Payments Regulation?

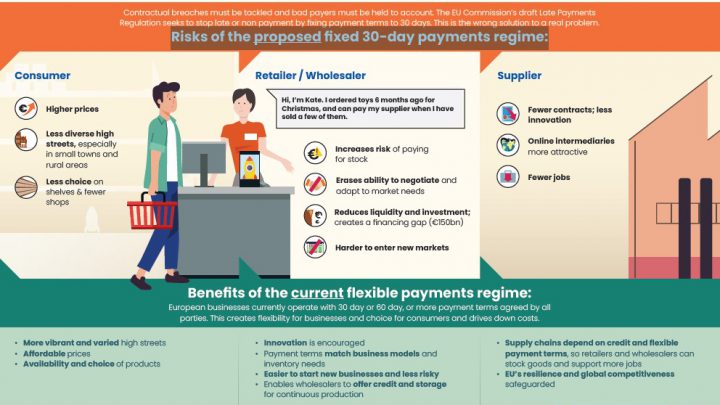

Europe’s retail and wholesale sector says no to unfair regulation. The EU has published a draft regulation on late payments, proposing fixed 30-day payment terms. This will create less flexibility for industry and less choice for consumers and drive up costs. It can create a financial gap between 100 to 150 billion euros for retail alone.

The draft Late Payments regulation seeks to address an important issue. Non-payments or late payments are unacceptable. Bad payers need to be held to account, but a shorter payment period won’t stop them breaking the rules. Focus on the problem not the payment terms. #FlexNotFixed

What does it mean?

Europe’s current payment system allows businesses to negotiate their payment terms; giving essential flexibility and choice in managing supply chains and serving their customers. They already take on risk, buying stock with no guarantee of purchase.

Europe has a vibrant retail and wholesale sector. Good ideas flourish, innovation is encouraged and people can buy what they want, whenever and wherever they want, at a price they can afford. We continue to invest but rigid new payment terms will put this at risk. #FlexNotFixed

Why should you care?

With razor-thin margins and high-interest rates, retailers and wholesalers will have to pass on the additional costs to consumers at a time of a severe cost-of-living crisis. It will reduce choice, by forcing retailers and wholesalers to focus on what sells best, to limit cashflow gaps. It will force a shift to more expensive production and delivery models, such as just-in-time.

The stark reality is that a large number of businesses will no longer be economically viable. Their closure will be felt in local job markets, in town centres and rural areas. This will also have ripple effects for other value chain actors from farmers to logistics that work with our sector on a daily basis. #FlexNotFixed

What’s the impact on the retail and wholesale sectors and the wider economy?

Strict payment terms erase the flexibility to negotiate, especially for businesses selling slow-moving or seasonal products. Less liquidity could hit communities hard with more bankruptcies in the retail sector leading to more vacant shops in the high street.

The impact of the EU’s proposed 30-day fixed payment term will be disproportionate and dramatic if the proposal is not reconsidered. It could cause huge disruption to a sector worth 10% to the European economy and cost up to €150bn to the retail sector alone. #FlexNotFixed

From 60 days to 30 days: Why flexibility and choice are important

Not paying on time is not fair and harms everyone. But if shorter term payment terms are introduced, it will create a less resilient economy, undermine the recovery, and lead to unfair competition with third countries selling goods into Europe.

Demand fluctuates through the year. Current payment rules work best for retailers and wholesalers who need to stock up, pay their suppliers, and give their customers max choice at affordable prices at different times. It’s a delicate but finely tuned value chain. #FlexNotFixed

What we believe needs to happen

Retailers & Wholesalers need flexibility to thrive. Long payments are not late payments if terms are agreed and followed. Our #FlexNotFixed campaign seeks to replace the EU proposal, to focus instead on better enforcement and capacity building. Don’t fix what isn’t broken.

We want bad payers to be held to account, but the current draft EU regulation is pushing for a solution too hard, too fast and too soon. We need to manage the risk, not make it worse. We need to work together to find a better solution. #FlexNotFixed

Payment Terms – FAQs

More information

Lists of related links to articles, decisions and draft reports:

- Proposal for a Regulation combating late payments – Why consignment & other contractual arrangements are not an answer

- European Commission Late Payments Regulation proposal

- Legislative observatory

- European Parliament IMCO draft Report

- Hearing in the European Parliament, intervention of Business Europe at 15:32 minutes

- Revision of the late payments Directive by the EESC

- The cost of pay me later by Allianz

Statements from Members of the European Parliament

- Stéphanie Yon-Courtin, France, Renew, Member of the European Parliament

-

Laurence Sailliet, France, EPP, Member of the European Parliament

- Svenja Hahn, Germany, Renew, Member of the European Parliament

Positions from Member States

Positions Other International Associations

- BusinessEurope

- EuroChambres

- International Chamber of Commerce (ICC) and the International Trade and Forfaiting Association (ITFA)

Positions National Associations

- German coalition of medium sized business representations

- Deutscher Handelsverband

- Bundesverband Großhandel, Außenhandel, Dienstleistungen

- Bundesverband der Deutschen Industrie

- Zentralverband des Deutschen Handwerks

Media articles

European level

- Brussels late payment crackdown threatens survival of SCF, industry warns

- EU payment rules shake-up will prompt price rises, retailers warn

France

- Délais de paiement : les fortes réserves de Bercy face au projet de réforme européen | Les Echos

- Délais de paiement: la réforme européenne, une bombe à retardement pour le commerce (lefigaro.fr)

- Opinion | Délais de paiement : quand l’Europe ignore la réalité des entreprises | Les Echos

Lithuania

Croatia

Spain

- Eurocommerce se planta ante la propuesta de pagos a 30 días

- El comercio europeo reclama mayor coherencia legislativa a la Unión Europea

- EuroCommerce reclama una legislación de mayor calidad y coherencia para el comercio europeo

- EuroCommerce pide revisar los pagos a 30 días por crear “una enorme brecha financiera”

- EuroCommerce reclama una legislación de mayor calidad

- EuroCommerce reclama en la Cumbre Social Tripartita una legislación de mayor calidad y coherencia para el comercio europeo

- Eurocommerce se planta ante los pagos a 30 días

- Morosidad y plazos de pago: la gran confusión del futuro Reglamento europeo

- Crítica del CESE a la propuesta de la Comisión sobre morosidad

Italia